Unlocking Future Growth: Innovative Paths in Investing

Understanding Emerging Markets

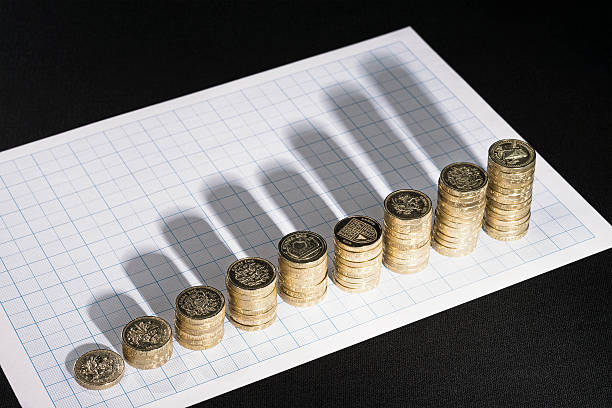

Emerging markets have long been a focal point for investors seeking substantial returns. These markets offer unique opportunities due to their rapid economic growth and expanding consumer bases. Countries like India, China, and Brazil have been at the forefront, showcasing significant increases in GDP and industrial advancements. By venturing into these economies, investors can tap into sectors that are thriving, such as technology, energy, and infrastructure.

Investors seeking a diversified portfolio often explore these markets, as they provide avenues to mitigate risks associated with saturation in developed markets. For example, understanding regional trends and local business dynamics can be beneficial. In the realm of digital investments, knowing monopoly live stats can offer insights into market behaviors and tendencies, aiding investors in making informed decisions. These statistics help identify patterns of consumer engagement and can reflect broader economic inclinations, contributing to strategic investment planning.

Technological Advancements in Investment

Technology is revolutionizing the investment landscape, with innovations like artificial intelligence and blockchain paving new paths for future growth. AI enables more precise market predictions and personalized portfolio management, while blockchain increases transparency and security in transactions. These technologies are not only reshaping traditional investment methodologies but also creating new asset classes altogether.

Cryptocurrencies, for example, have emerged as both a disruptive force and an attractive investment vehicle. As blockchain’s applications expand beyond digital currency, investors are exploring avenues like decentralized finance (DeFi) to diversify their portfolios. This evolution signifies a paradigm shift in how wealth is generated and managed, offering investors unprecedented control and opportunities in the digital realm.

Sustainable and Impact Investing

As societal awareness of environmental and social issues grows, sustainable and impact investing have surged in popularity. These investment strategies focus on generating measurable environmental and social benefits alongside financial returns. Companies with strong ESG (Environmental, Social, and Governance) practices are increasingly favored by investors looking to align their portfolios with their values.

The appeal of this investment path lies in its potential to drive systemic change while still achieving competitive returns. As regulatory environments become more stringent and consumer preferences shift towards sustainability, businesses that prioritize ESG factors tend to outperform their peers, presenting an attractive proposition for conscious investors.

Exploring Monopoly Live Stats

Monopoly Live Stats offers a unique lens into understanding digital consumer engagement and game analytics. As an innovative platform, it captures a variety of metrics that enable investors to gauge market interest and trends within the booming online gaming industry. This data is crucial for making informed investment decisions, particularly for stakeholders looking to venture into entertainment and tech sectors.

By analyzing user behavior, frequency of play, and demographic preferences, Monopoly Live Stats provides insights that are invaluable in predicting future market shifts. Investors who leverage such data-driven insights can gain a competitive edge, anticipating technological advancements and consumer trends that drive industry growth. This platform exemplifies how digital tools can enhance investment strategy in today’s data-centric world.